Book Review: The Total Money Makeover 3rd Edition, by Dave Ramsey Reviewed by: W. Devin Wolf, CFP® Dave Ramsey is a well-known financial author, radio host, TV personality, and public speaker whose message focuses on getting out of debt and building wealth. I have been asked my opinion on Ramsey’s philosophies by a number of clients, prompting me to read his book. The basic message of the book is to live below your means, don’t take on debt, and be disciplined. I love this message and think it is a great recipe for success. However, the recommended paths to accomplish financial freedom are definitely not the most efficient and in some instances the advice is outright dangerous. The book is written from the perspective “that personal finance is 80% behavior and only 20% head knowledge.” This concept rings true but I think it may also explain why Ramsey chooses some less-than-efficient recommendations for his readers. Let’s go through the steps recommended by the book and I’ll highlight what I found to be good and bad. Although there is some good advice presented throughout the book, I recommend anyone planning to follow Ramsey’s recommendations first read my review of “Step Four,” as the advice in this area could easily lead to financial disaster.

Step One: Save $1,000 as a Starter Emergency Fund ![]() No complaints here.

No complaints here.

Step Two: Start the Debt Snowball ![]()

![]() The “Debt Snowball” is essentially listing all debts from smallest to largest (excluding mortgage) and dedicating all financial resources to paying off the debt in order from smallest to largest. By “all financial resources” Ramsey is referring to income not required for daily living, selling non-retirement account assets, and not contributing to retirement plans (even if you receive a match from your employer). Getting disciplined and feverishly getting out of debt is great, but there are more efficient ways to go about this. Listing your debts by highest percentage rate and paying those off first mathematically results in the least amount of interest paid and paying the debt off faster. In addition, making contributions to your retirement plan to receive a match is also typically more advantageous mathematically. The bottom line is if you are disciplined and committed to your plan, there are methods that will result in accumulating more wealth. If you struggle with discipline and need to feel the sense of accomplishment from paying off a few small debts to stay the course, the Ramsey approach may work for you.

The “Debt Snowball” is essentially listing all debts from smallest to largest (excluding mortgage) and dedicating all financial resources to paying off the debt in order from smallest to largest. By “all financial resources” Ramsey is referring to income not required for daily living, selling non-retirement account assets, and not contributing to retirement plans (even if you receive a match from your employer). Getting disciplined and feverishly getting out of debt is great, but there are more efficient ways to go about this. Listing your debts by highest percentage rate and paying those off first mathematically results in the least amount of interest paid and paying the debt off faster. In addition, making contributions to your retirement plan to receive a match is also typically more advantageous mathematically. The bottom line is if you are disciplined and committed to your plan, there are methods that will result in accumulating more wealth. If you struggle with discipline and need to feel the sense of accomplishment from paying off a few small debts to stay the course, the Ramsey approach may work for you.

Step Three: Finish the Emergency Fund ![]() In this step you save 3-6 months’ expenses for your emergency fund. I like this advice with the exception that matching retirement funds are still ignored.

In this step you save 3-6 months’ expenses for your emergency fund. I like this advice with the exception that matching retirement funds are still ignored.

Step Four: Retirement Investing ![]()

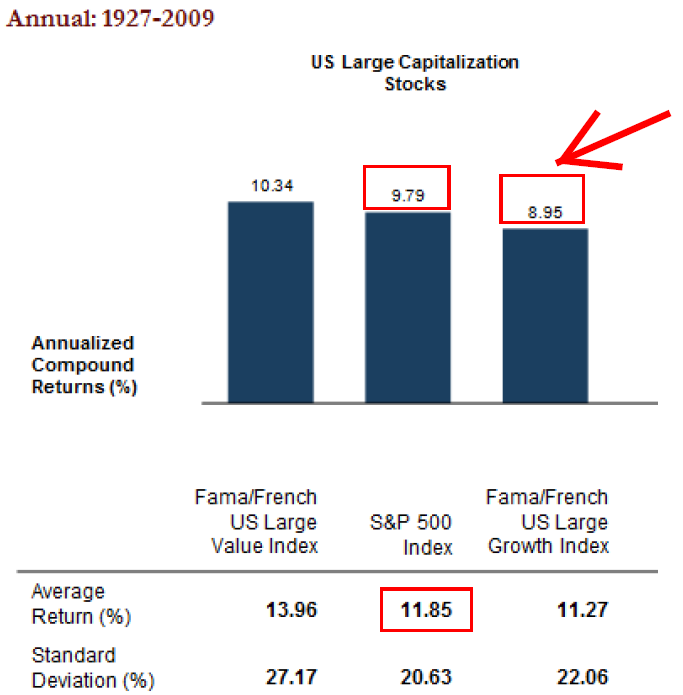

![]() The section begins well with the recommendation to invest 15% of your income for retirement. This number is somewhat useless because it ignores age and when you want to retire, but as a rule of thumb, it isn’t terrible. What are terrible are the specific recommendations the book makes to accomplish a successful retirement. Let’s take a look at these. Use mutual funds, specifically growth-stock mutual funds.The book implies that, by following this strategy, you should receive 12% return on your investment. To support this point the book cites the historical average return of the S&P 500 TR index*. As demonstrated by the chart below, although the returns of the S&P 500 did average 11.85% each year from 1927-2009, the annualized compound return (return you would actually receive as an investor) is only 9.79%. Furthermore, growth stock mutual funds historically have underperformed the index and only had an annualized compound return of 8.95%. In addition, these returns are of indexes, which you can’t actually invest in directly. In reality, there are expense ratios of mutual funds, cost of investment advice, turnover impacts, and cash drag, all of which impact your returns. If you add these up, I would be willing to bet the average growth stock investor would be lucky to earn an 8% average compound return.

The section begins well with the recommendation to invest 15% of your income for retirement. This number is somewhat useless because it ignores age and when you want to retire, but as a rule of thumb, it isn’t terrible. What are terrible are the specific recommendations the book makes to accomplish a successful retirement. Let’s take a look at these. Use mutual funds, specifically growth-stock mutual funds.The book implies that, by following this strategy, you should receive 12% return on your investment. To support this point the book cites the historical average return of the S&P 500 TR index*. As demonstrated by the chart below, although the returns of the S&P 500 did average 11.85% each year from 1927-2009, the annualized compound return (return you would actually receive as an investor) is only 9.79%. Furthermore, growth stock mutual funds historically have underperformed the index and only had an annualized compound return of 8.95%. In addition, these returns are of indexes, which you can’t actually invest in directly. In reality, there are expense ratios of mutual funds, cost of investment advice, turnover impacts, and cash drag, all of which impact your returns. If you add these up, I would be willing to bet the average growth stock investor would be lucky to earn an 8% average compound return.  “You are secure and will leave a nice inheritance when you can live off 8 percent of your nest egg per year.” The book indicates that once the amount you need to live off is equal to 8% of your retirement assets, (the original 12% minus 4% for inflation) you have accumulated enough to retire. The book also never mentions adding more stable assets to your portfolio like bonds in retirement. The impacts of being this aggressive can be devastating. For example, someone who retired in January of 2000 with a $375,000 100% S&P 500 TR index portfolio and began withdrawing $2,500 per month ($30,000 a year, or 8% of the $375,000) would have completely depleted their portfolio by September of 2010. Their portfolio summary would look like this:

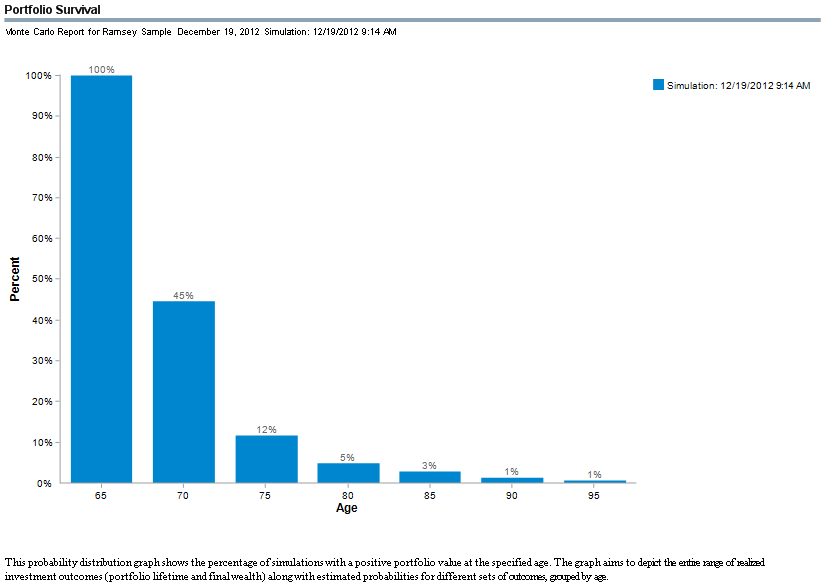

“You are secure and will leave a nice inheritance when you can live off 8 percent of your nest egg per year.” The book indicates that once the amount you need to live off is equal to 8% of your retirement assets, (the original 12% minus 4% for inflation) you have accumulated enough to retire. The book also never mentions adding more stable assets to your portfolio like bonds in retirement. The impacts of being this aggressive can be devastating. For example, someone who retired in January of 2000 with a $375,000 100% S&P 500 TR index portfolio and began withdrawing $2,500 per month ($30,000 a year, or 8% of the $375,000) would have completely depleted their portfolio by September of 2010. Their portfolio summary would look like this:  The results are even more devastating when you combine the bad assumptions of 12% per year returns with the 8% withdrawal rate, but there is a worksheet in the book that does just that. The worksheet gives an example of someone who needs $30,000 a year income in today’s dollars to retire. Using the 8% withdrawal rule the book calculates a $375,000 nest egg is needed. For a 30 year old who wants to retire at age 65, the worksheet indicates $163.50 per month must be saved to meet the goal. However, if you change the assumptions to have a 4% initial withdrawal rate and 4% real return above inflation (this number is probably still too high) you would actually need to save $820.81 each month for retirement. The results of these bad assumptions are saving one fifth of what you should be. To better understand how these assumptions impact chances of success, I ran a Monte Carlo analysis using the book’s assumptions, except I changed the return of the investment portfolio to 8% (instead of 12%). I used a 30 year old who retires at age 65 and needs to withdrawal $30,000 a year in today’s dollars to live on after age 65. I assumed they save $163.50 a month until age 65 as shown in the book and used a standard deviation of 15% for the portfolio. The results were astounding. The investor only had a 1% chance of their portfolio lasting until they were 90 years old (ideally we would build a plan that results in a 95% chance of portfolio survival at this age). The full results are shown below.

The results are even more devastating when you combine the bad assumptions of 12% per year returns with the 8% withdrawal rate, but there is a worksheet in the book that does just that. The worksheet gives an example of someone who needs $30,000 a year income in today’s dollars to retire. Using the 8% withdrawal rule the book calculates a $375,000 nest egg is needed. For a 30 year old who wants to retire at age 65, the worksheet indicates $163.50 per month must be saved to meet the goal. However, if you change the assumptions to have a 4% initial withdrawal rate and 4% real return above inflation (this number is probably still too high) you would actually need to save $820.81 each month for retirement. The results of these bad assumptions are saving one fifth of what you should be. To better understand how these assumptions impact chances of success, I ran a Monte Carlo analysis using the book’s assumptions, except I changed the return of the investment portfolio to 8% (instead of 12%). I used a 30 year old who retires at age 65 and needs to withdrawal $30,000 a year in today’s dollars to live on after age 65. I assumed they save $163.50 a month until age 65 as shown in the book and used a standard deviation of 15% for the portfolio. The results were astounding. The investor only had a 1% chance of their portfolio lasting until they were 90 years old (ideally we would build a plan that results in a 95% chance of portfolio survival at this age). The full results are shown below.  As you can see, following the advice in this section of the book can be very harmful to your wealth. There is more bad advice, including choosing your investments based on past performance track records (see my 5 star Euphoria article for more information on why picking based on past performance doesn’t work), but let’s just leave it at this: This section of the book should be approached with caution. One of the biggest problems is this section fails to consider the behavioral element of investing. People who approach investing with the unrealistic expectation of making a 12% return on their money will soon realize they are not making 12% and abandon their plan. More on this subject can be found under the behavioral coaching section of our website.

As you can see, following the advice in this section of the book can be very harmful to your wealth. There is more bad advice, including choosing your investments based on past performance track records (see my 5 star Euphoria article for more information on why picking based on past performance doesn’t work), but let’s just leave it at this: This section of the book should be approached with caution. One of the biggest problems is this section fails to consider the behavioral element of investing. People who approach investing with the unrealistic expectation of making a 12% return on their money will soon realize they are not making 12% and abandon their plan. More on this subject can be found under the behavioral coaching section of our website.

Step Five: Save for College ![]()

![]() This section of the book has little meat to it, but they do favor 529 plans as the college funding vehicle, which is why they earn the thumbs up. Once again, Ramsey recommends an all equity portfolio and uses a 12% return in his spreadsheets. This recommendation is even worse in the college funding arena as you only have an 18 year time horizon before the funds will be needed.

This section of the book has little meat to it, but they do favor 529 plans as the college funding vehicle, which is why they earn the thumbs up. Once again, Ramsey recommends an all equity portfolio and uses a 12% return in his spreadsheets. This recommendation is even worse in the college funding arena as you only have an 18 year time horizon before the funds will be needed.

Step Six: Pay off Mortgage ![]()

![]() The book recommends paying cash for your house, but if you can’t wait that long, a 15 year fixed mortgage where the payment is less than 25% of your income. This advice gets back to being disciplined and living below your means, which earns it a thumbs up. It doesn’t take a mathematician to realize that if you have a 3% mortgage relative to a 12% investment return (Dave’s number, not mine) you are mathematically way better off investing rather than accelerating payments on your mortgage. The book attempts to apply half-truths regarding taxes and risks to justify this. In reality, if you buy a modest house, have good equity, have your emergency fund, and the payment is 25% or less of your income, the risk is relatively low. Paying off your house prior to retirement is a noteworthy goal, and can increase your chances of success in retirement by lowering the non-discretionary withdrawals.

The book recommends paying cash for your house, but if you can’t wait that long, a 15 year fixed mortgage where the payment is less than 25% of your income. This advice gets back to being disciplined and living below your means, which earns it a thumbs up. It doesn’t take a mathematician to realize that if you have a 3% mortgage relative to a 12% investment return (Dave’s number, not mine) you are mathematically way better off investing rather than accelerating payments on your mortgage. The book attempts to apply half-truths regarding taxes and risks to justify this. In reality, if you buy a modest house, have good equity, have your emergency fund, and the payment is 25% or less of your income, the risk is relatively low. Paying off your house prior to retirement is a noteworthy goal, and can increase your chances of success in retirement by lowering the non-discretionary withdrawals.

Conclusion Although the underlying principles of live below your means, don’t take on debt, and be disciplined are good, there is simply too much harmful information for me to recommend this book. For the book to be effective, the reader would need to buy in to the principles, and I fear the average person may not be able to filter the good information from the bad. If I were to recommend this book, it would be only to someone with significant debt who emotionally hadn’t been able to find a system that works for them. For any disciplined person who has already begun building wealth, there are much more efficient ways to accomplish financial freedom by tailoring a financial plan to their individual goals. *The S&P 500 TR is an index used only for hypothetical purposes. Indices are not available for direct investment and the performance does not reflect the expenses associated with management of an actual portfolio. Past performance does not predict future performance.

- Putting your business cash to work - May 16, 2024

- Out of the Mouths of Babes - April 17, 2024

- It’s a new year: What we know and what is to come - January 8, 2021